Moving on from customer surveys

Why do customers choose you?

A man walks into a bar …

The bar chain carries out some customer analysis. Customer Effort Score (CES) tells them it was easy for him to get served. Customer Satisfaction Score (CSAT) tells them he was satisfied when he left. Net Promotor Score (NPS) tells them he has a positive perception of their brand. Market analysis tells them about the suppliers, logistics and brand positioning of the two rival bar chains on the same street.

But none of these metrics tell them why the man walked into their bar. And they don’t tell them why, next time he fancies a drink, the same man chooses the bar next door. Or what they could do to change that.

Limitations of old-school CX analytics

CX performance is always relative. How successful you are at attracting customers is relative to how well other market players are doing the same thing.

Effective CX analysis should empower you to make strategic moves that influence customers to choose you more often, winning you market share from rivals.

But current CX analysis fails to do this.

- Data from customer surveys is biased and unreliable. It doesn't give you a true picture of why customers choose to shop with you.

- Current analytics lacks critical context on how you compare to your competitors and how customers choose between alternative solutions.

Your current analytics tool box

Current competitive analytics tools do some jobs well. They assess the status of rivals, suppliers, buyers, substitute products, and potential entrants, providing insight on a competitor’s moves in the market, eliminating surprises.

But current competitor analysis involves making sense of ambiguous, multidimensional market and operational data, typically incomplete or incomparable at source.

And tactical execution against these factors can remain a disconnected guessing game, or a never-ending, costly, cycle of test-and-learns. So, much investment falls flat as a result.

Competitor analysis tools are limited

The challenge with current competitor analysis tools is that they are far removed from the point of customer choice – the moment when a customer chooses you, or a rival. And choice of retailer rarely happens in-store, or even in-town or in-browser.

Effective analysis should deliver accurate descriptions of how a customer will choose for a particular customer story, and what a business can do to influence that choice.

It should consider the behavioural science of human decision-making.

Current industry sector and macro-environmental analysis struggle to deliver this insight because those forces are distant from that moment of decision.

Worse, current analysis lacks comparable data between you and your rivals. You have your own deep data but replicating the same in a rival’s business has up until now appeared to be impossible.

Survey tools are flawed

Current retail performance measurement relies heavily on customer surveys to evaluate the customer decision-making environment. Customers are asked to report on their own decision-making and predict future decisions. Growth strategy is built on interpretation of the data from these surveys.

But although customer surveys can be effective at uncovering operational issues, they are inadequate to the task of evaluating a complex decision-making environment with multiple competitive options.

Humans are poor at analysing our own decisions. A string of natural cognitive biases mean customer surveys cannot deliver reliable insight into the customer decision-making process.

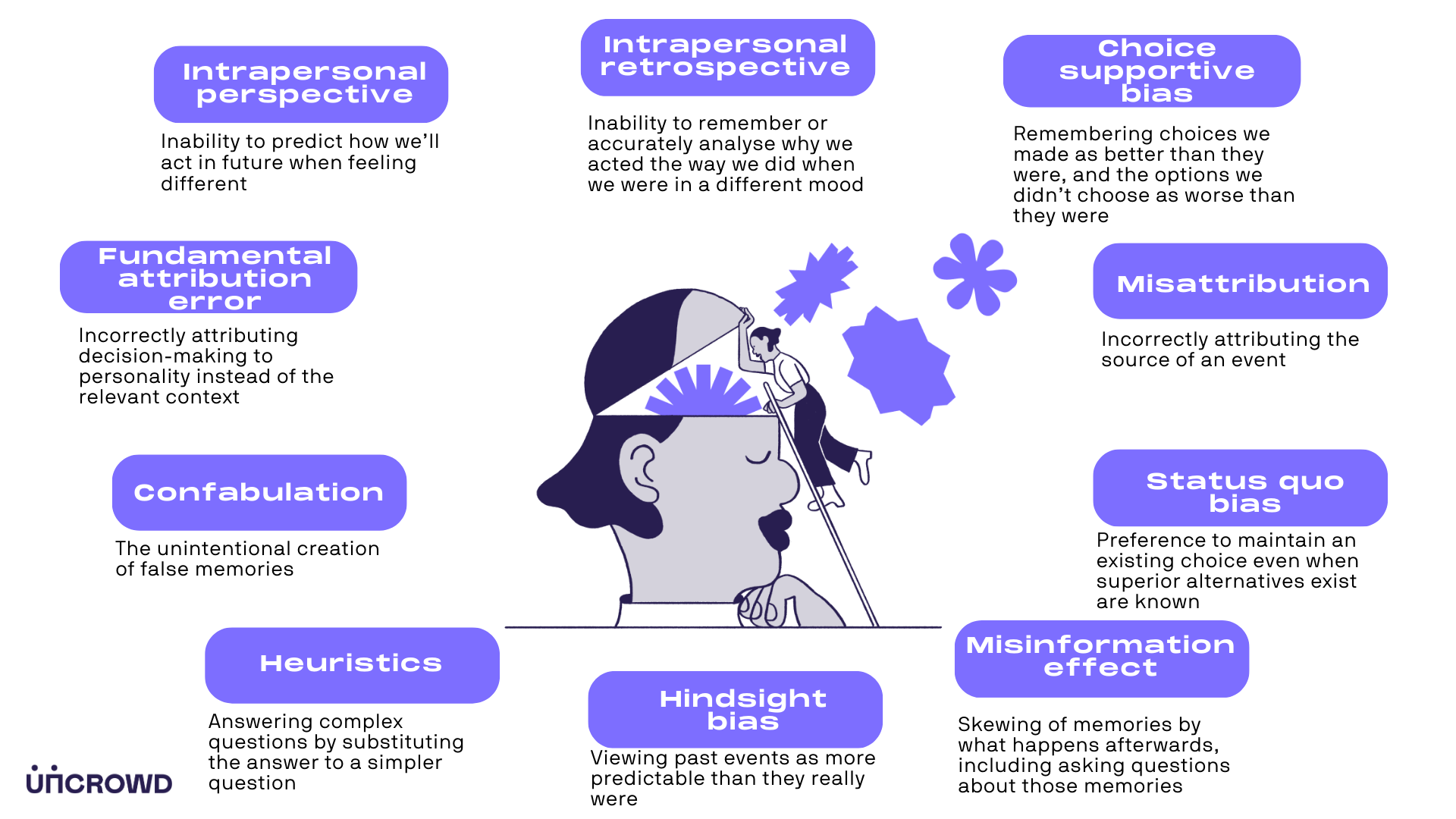

Such cognitive biases include:

- Heuristics - answering complex questions using simplifying operations

- The Fundamental Attribution Error - failing to recognise the importance of context in decision-making

- Confabulation - the unintentional creation of false memories

- Misattribution - wrongly attributing the source of an event

- The Misinformation Effect - memories being influenced by subsequent events

- The Intrapersonal Perspective - inability to predict how we’ll act in future when feeling different

- The Intrapersonal Retrospective - inability to accurately analyse why we acted the way we did when we were in a different mood

- Status Quo Bias - preference to maintain an existing choice even when ‘obviously’ superior alternatives exist and are known

- Hindsight Bias - viewing past events as more predictable than they really were

- Choice-supportive Bias - remembering the choices we made as better than they were and remembering the options we didn’t choose as worse than they were

(See our Further Reading section for more information on cognitive bias.)

These natural biases undermine the reliability of customer survey data, the established tool for analysing CX.

Unreliable memories

Customer surveys ask customers to remember their experience and report on it. This is a fundamentally flawed way to try to uncover the truth about CX, because human memory is unreliable.

We know instinctively that longterm memory is unreliable, but recent research (University of Amsterdam, 2023) has shown that errors are introduced into our memory within a few seconds of an event.

That means that even customer surveys that are carried out at the tills in-store, or the same day, may contain errors, rendering them unreliable as a basis for strategic investment.

When the metrics don't work

Customer perception feedback metrics are dogged by other fundamental problems:

- High data volume required to deliver meaningful insight

- Vulnerable to gamification by staff

- Dominated by negative bias from disgruntled customers

- Lacking in actionable detail

- Questionable subjective input

- Reporting point-in-time responses rather than long-term loyalty

- Lack of connection between perception insight and commercial application

- Inward-looking, using data from within an organisation, ignoring competitive influences.

To improve customer experience strategy, retailers need a new metric that moves them away from relying on survey data.

And they need a retail performance measurement metric that also shows them how their CX compares to their competitors and how that influences customer choice.

So, what’s the alternative?

Further Reading

Zahra, S. A., & Chaples, S. S. (1993). Blind spots in competitive analysis, Academy of Management Perspectives, 7(2), 7-28.

Fleisher, C. S., & Bensoussan, B. E. (2015). Business and Competitive Analysis: Effective Application of New and Classic Methods. Pearson FT Press.

Gordon, I. (1989). Beat the Competition: How to Use Competitive Intelligence to Develop Winning Business Strategies. Basil Blackwell Publishers. Retrieved 6 27, 2022

Porter, M. (n.d.). The Five Competitive Forces That Shape Strategy. Retrieved 6 27, 2022, from The Harvard Business Review: http://hbr.org/2008/01/the-five-competitive-forces-that-shape-strategy/ar/1

Darley and Batson, From Jerusalem to Jericho, Journal of Personality and Social Psychology Vol.27 , 1973

Lee Ross, Teresa Amabile, Julia Steinmetz, Social Roles, Social Control and Biases in Social-Perception Processes, Journal of Personality and Social Psychology Vol 35, 1977

Christian Rudder, Dataclysm: Who We Are When We Think No-one’s Looking, 2014

David Hargreaves, Jennifer Kendrick, The Influence of In-Store Music on Wine Selections, Adrian North, Journal of Applied Psychology, Vol 84, 1999

Linda A. Henkel, Mara Mather, Memory attribution for choices: How beliefs shape our memories, 2007, August 2007, Journal of Memory and Language

Ryan Carlson, Michel Marechal, Bastiaan Oud, Ernst Fehr, Molly Crocket, Motivated Misremembering: Selfish decisions are more generous in hindsight, 2018

Richard Shotton, The Choice Factory: 25 Behavioural Biases that Influence What We Buy, Harriman House, 2018

David E Bell, Ralph L. Keeney, John D. C Little, A Market Share Theorem, Massachusetts Institute of Technology, 1974

Adam Kucharski, The Rules of Contagion: Why Things Spread - and Why They Stop, Wellcome Collection, 2020